- Home

- Podcast

- Listen On Your Favorite Platform

- Rate & Review The Show

- All Episodes with Show Notes

- About The Maverick Show

- Travel

- Work & Travel with Remote Professionals

- Travel Gear I Use and Recommend

- Digital Nomad Insurance

- Video Training: Stylish Minimalist Packing

- Top 10 Essential Apps for Digital Nomads

- Top 10 Essential Books for Digital Nomads

- Resources

- Podcast Equipment & Vendors I Use to Produce The Maverick Show

- How to Become a Remote Freelancer With Your Current Skills

- 7 Keys to Building a Location-Independent Business

- Real Estate Investing for Digital Nomads

- Video Consult on Buying Turnkey U.S. Rental Properties

- Newsletter ▼

- Contact

- Recommend/Apply to Be a Guest

- Book Matt on Your Podcast

- Book Matt as a Speaker or Facilitator

- Book Matt for a Media Interview

- Sponsor/Advertise on the Show

- Download Matt’s Media Kit

In-depth conversations with today’s most interesting world travelers, remote entrepreneurs, and digital nomads.

Insurance for Digital Nomads:

Securing Your Nomadic Lifestyle

The last time I was on the island of Koh Pha Ngan in Thailand, I was there with some digital nomad friends, and we were enjoying the beach, exploring the island and planning to attend the legendary Full Moon Party. Then, all of a sudden, one of my friends got dengue fever and ended up in the hospital. Then, my other friend who had rented a moped to drive around the island got in an accident and ended up in the hospital as well. And then, my third friend was literally just walking down the beach and got bitten by a stray dog and ended up in the hospital too. Ever since then, I’ve been recommending my friends get Nomad Insurance by SafetyWing.

Why Choosing the Right Insurance is Crucial for Digital Nomads

Most people think about the various types of insurance we need in 3 main categories:

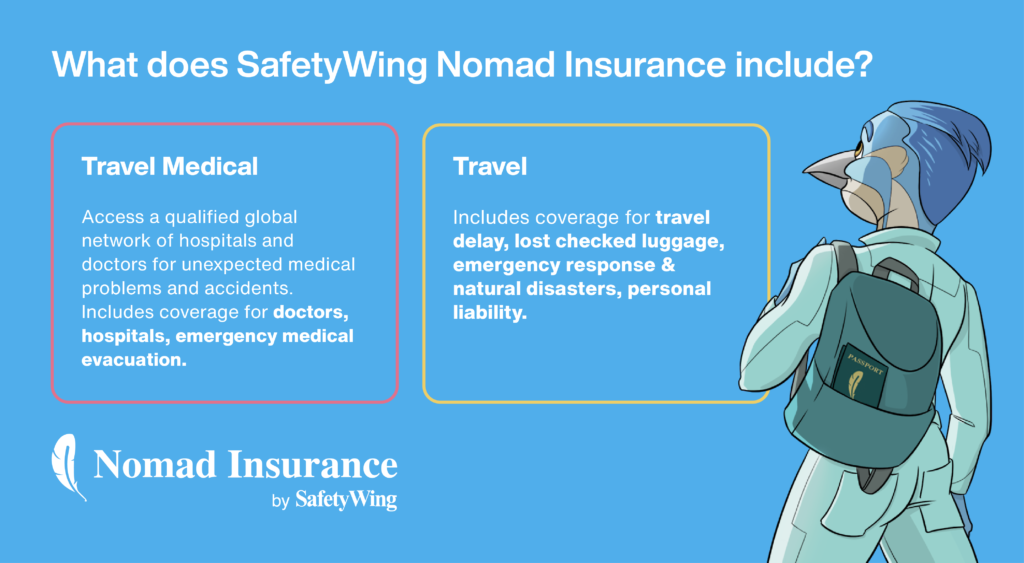

Digital Nomad Health Insurance:

This covers medical expenses incurred while abroad, ensuring access to quality healthcare anywhere in the world, as well as emergency evacuations if necessary, etc.

Digital Nomad Travel Insurance:

This covers travel mishaps like natural disasters, emergency response, personal liability, lost luggage and food and accommodation expenses during travel delays, etc.

Digital Nomad Gadget Insurance:

This covers stolen electronic devices, like our laptops, tablets and cameras, that are essential to our lives and businesses as digital nomads.

Selecting The Best Insurance Policy for the Digital Nomad Lifestyle

When selecting an insurance policy, it’s important to look for features that cater to a globally mobile lifestyle. There are a myriad options available in the broad category of “travel insurance” and products like World Nomads, IMG Global, or Cigna Global all provide international coverage. However, SafetyWing is unique for its combination of healthcare and travel benefits, lower cost, a flexible monthly subscription-like model, and being specifically tailored to the needs of our digital nomad lifestyle. Here are the main reasons I recommend it to my friends.

10 Reasons SafetyWing is Uniquely Advantageous for Digital Nomads

1) It’s the Travel Lifestyle Coverage We Actually Need as Digital Nomads

With SafetyWing, if you get sick or injured abroad, you can visit any doctor or hospital for medical treatment, and it even covers evacuation to a better equipped hospital if you need it. It covers flights home if something bad happens, like a death in the family, and you get continuous coverage during your visits back home for up to 30 days (15 days in the U.S). It covers you for motor accidents, natural disasters, personal liability, and even covers your lost luggage as well as your food and accommodation expenses if you have a travel delay over 12 hours.

2) Continuous Global Coverage

SafetyWing covers people from all over the world while you are outside your home country. Spanning over 180 countries, it ensures you have continuous health coverage no matter where your travels take you or how frequently you change countries.

3) Month-To-Month Flexibility

You can choose to have your insurance renew automatically every 28 days, similar to a subscription service, and you can cancel anytime. This flexibility is ideal for digital nomads because our travel plans and durations often change unpredictably.

4) Buy It While Abroad with No Duration Limit

You can sign up for Nomad Insurance by SafetyWing before you depart or at any point during your journey abroad. And, unlike many travel insurances that cap the travel duration (typically at six months), SafetyWing allows you to keep your coverage as you continue traveling with no duration limit.

5) Affordability

Compared to other insurance providers that offer global coverage, I found SafetyWing surprisingly affordable. This makes it accessible for newer digital nomads and those on a tighter budget.

6) Coverage for Young Dependents

A unique feature of SafetyWing is that one young child per adult (up to two per family), aged under 10 years old, can be included in the insurance without additional cost. This is a significant benefit for nomadic families.

7) Gadget Insurance

Since so much of our digital nomad lives and business runs through our laptops and smartphones, SafetyWing offers “Electronics Theft” insurance that you can add on which covers electronics like laptops, tablets and cameras.

8) Adventure Sports Coverage

If you’re like a lot of my digital nomad friends who are regularly jumping out of planes to go skydiving, running off cliffs to go paragliding, and doing other types of adventure sports, SafetyWing has special coverage for you that you can add on to cover all that as well.

9) No Deductible and a Simple Claims Process

Unlike most insurance policies, Safety Wing has no deductible, and the claims process takes less than 5 minutes.

10) 24/7 Customer Service

Real (and friendly!) humans respond in a less than a minute via live chat an all hours, whenever you need them.

What Does Digital Nomad Insurance Cost?

Generally speaking the cost of travel medical insurance can vary widely based on factors like age, health, destination, your home country, the length of coverage, and the company providing the coverage. However, SafetyWing has simplified all of this and reduced the cost well below what I thought it would be. To see exactly what Nomad Insurance by SafetyWing would cost you personally in a few seconds, use the calculator at the top.

Designed by Nomads, for Nomads

SafetyWing was built by a team of digital nomads, which means they have a firsthand understanding of our challenges and needs which has helped them tailor their services effectively to the digital nomad community.

+ Check it Out Now

Conclusion

As you chart your course through various countries, working and living your best life around the world, remember that the right insurance isn’t just about managing risks—it’s about ensuring peace of mind, allowing you to fully embrace the digital nomad experience.

The best blend of affordability, flexibility, and comprehensive coverage across the globe that I’ve come across so far is Nomad Insurance by Safety Wing. It’s tailored specifically to meet the needs of remote workers and long-term travelers, which is why I recommend it to all of my digital nomad friends.

Hosted by Matt Bowles

333: Afro-Colombian Storytelling, Hidden Histories, and Traveling to Sierra Leone with Eileen Ivette